The Intelligence Platform Powering KPA

Advanced technology engineered specifically for banking operations through Knowledge Process Automation

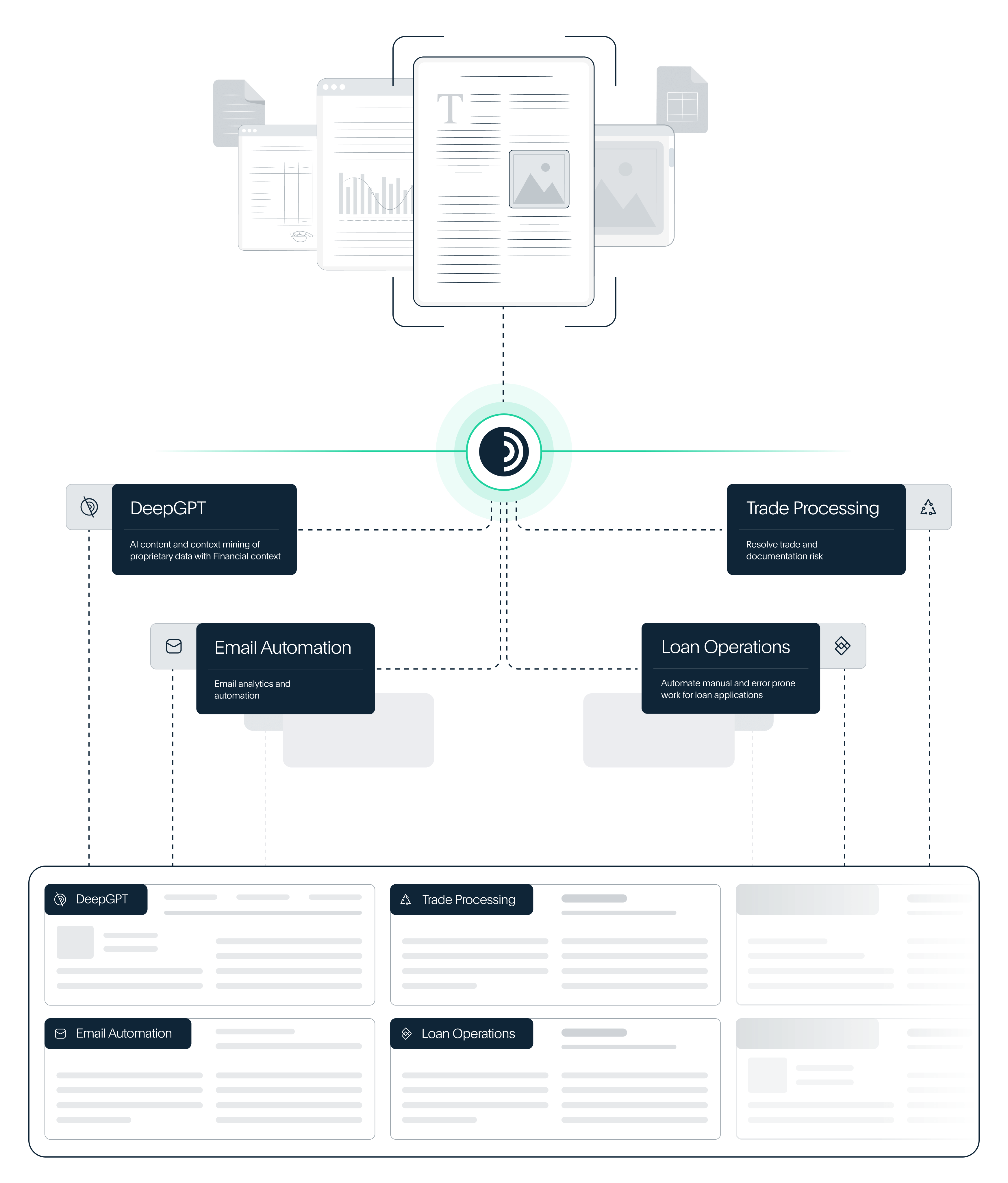

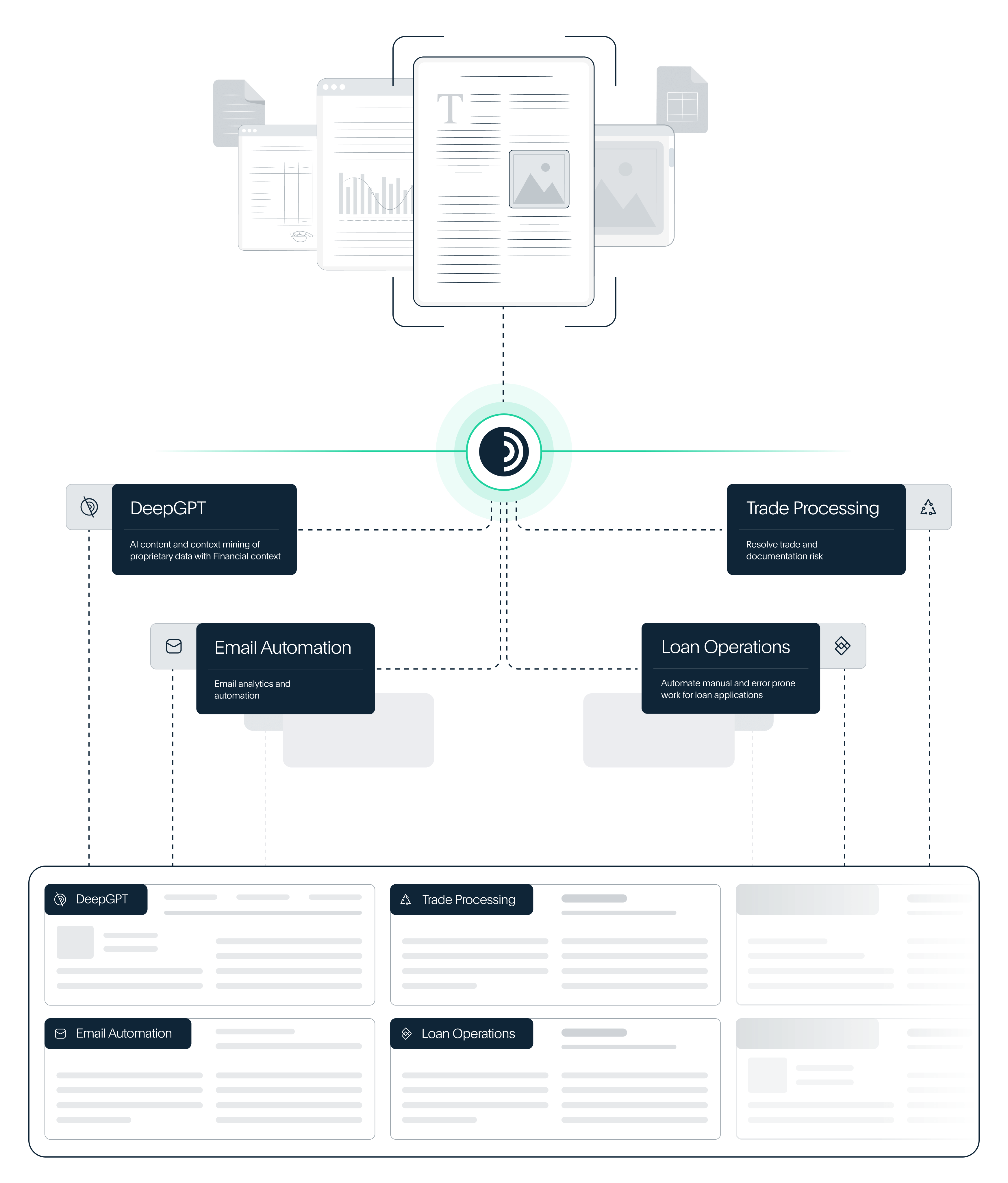

DeepSee combines sophisticated AI agents, deep financial expertise, and enterprise-grade security into a unified platform that transforms how financial institutions operate. Our technology powers the next generation of banking automation, delivering unprecedented efficiency while maintaining the highest standards of accuracy and compliance.

Efficiency

Productivity

Risk Mitigation

How We Help

DeepSee Agents analyze disparate data sets and automate banking-specific tasks, while also providing the transparency compliance teams require.

Community

Banks

Supercharge your teams to focus on what matters most. Whether you’re just beginning your automation journey or enhancing existing processes, our AI Agents are designed to streamline labor-intensive tasks, improve operational efficiency, and unlock new revenue opportunities. Let us help you transform productivity while enabling your team to prioritize strategic growth initiatives.

See Agents

Financial Markets Infrastructure

Enhance your offerings with domain-specific expertise. While large system integrators and horizontal AI platforms provide scale, we bring deep financial services knowledge to the table. Our AI Agents integrate with existing systems, enriching them with contextual intelligence to tackle the complexities of financial markets. Together, we’re elevating the standard for innovation in financial infrastructure.

See Agents

Capital

Markets

Built for the most sophisticated firms on Wall Street. Our AI Agents deliver proven results across front, middle, and back-office operations at leading financial institutions. From streamlining workflows to scaling complex processes, we help broker-dealers and capital markets achieve operational excellence and drive measurable outcomes in the most demanding and heavily regulated environments.

See AgentsOur AI Agents for Banking

DeepSee’s specialized AI agents are designed to solve specific challenges in the banking sector, from streamlining operations to enhancing customer experiences.

Check Processing

Agent Role:

Extract and validate

incoming checks

Agent Outcomes:

Enables more trading activity

- Ingests images in any format and quality

- Automatically applies validation logic

- Detects anomalies and potential fraud

Check Scanning for Marketing

Agent Role:

Scan and record info

on inbound checks

Agent Outcomes:

Target marketing campaigns

- Use during key acquisitions

- Enhanced prospecting data

- Create easy mailer list for potential new members

Client/Advisor Retention

Agent Role:

AUM retention prediction

Agent Outcomes:

Retain your advisors and clients

- Analyze historical trade and balance activity

- Predict clients and advisor departure

- Alerts 3-6 mos. in advance

Commercial Loan Funding

Agent Role:

Automate reading, extraction and data entry of legal documents

Agent Outcomes:

Faster loan throughput & accuracy

- Capture accurate floating/variable rates

- Eliminate complexity of legalese

- Zero risk of manual entry error

Core Reconciliation

Agent Role:

Extract, label, and reconcile processes from disparate systems of records

Agent Outcomes:

Streamline data silos / systems

- Eliminate manual data entry/checks

- Advanced integration to core systems

- Provide intelligence and HITL feedback

DeepGPT

Agent Role:

AI content and context mining of proprietary data with financial services context

Agent Outcomes:

Chat with your data

- Knowledge base for team to use

- Easily updates and refines data

- Capture domain knowledge

Email Automation

Agent Role:

Email analytics and automation

Agent Outcomes:

Optimize your email flow

- Generated responses rooted in your data

- Data to drive immediate automation

- Streamlined workflow

Indirect Lending

Agent Role:

Automate manual & error prone work for loan applications

Agent Outcomes:

Faster loan throughput and funding

- Eliminate manual data entry

- Provide inline data quality

- Focus FTEs on Member/Customer Service

KYC Case File Analysis

Agent Role:

Resolve trade and documentation risk

Agent Outcomes:

Augment client due diligence

- Extract critical data from client documents

- Suggests reasoning narratives & actions

- Coordinates across teams

Loan Operations

Agent Role:

Automate manual & error prone

work for loan applications

Agent Outcomes:

Originate more loans faster

- Eliminates manual data entry

- Provide inline data quality

- Focus FTEs on higher value work

Loan Portfolio Audit/Data Quality

Agent Role:

Scrub loan portfolio to confirm accuracy of rates in core system

Agent Outcomes:

Accurate floating interest rates

- Change from spot check to full audit

- Improve reporting and insights

- Eliminate discrepancies across LOS & Core

Matching Engine

Agent Role:

Content matching from

multiple Systems of Record

Agent Outcomes:

ID and manage external breaks

- Daily highlights of trading breaks

- Escalate risks on daily close-outs

- Focus team on resolution instead of review

One View

Agent Role:

Connects content from

disconnected data sets

Agent Outcomes:

Unlocks optimization insights

- Single pane of glass to track system flows

- Simulate enhanced flows in client pitches

- Supports more volume

Security Settlements

Agent Role:

Resolve Settlement

Breaks

Agent Outcomes:

Enables more trading activity

- Generates responses based on your data

- Eliminates duplication and repeat tasks

- Generates cost-per-trade data

Standing Settlement Instructions

Agent Role:

Maintains SSI data

in any format

Agent Outcomes:

Accurate SSI data

- Zero delay in updating SSI data from clients

- Elimination of fails due to bad SSI data

- Identification of missing data

Trade Reconciliation

Agent Role:

Resolve Trade and

Documentation Risk

Agent Outcomes:

Enables more trading activity

- Resolve trade breaks with 100% accuracy

- Focus team on faster resolutions

- Auditability and transparency

Watch Tower

Agent Role:

Monitor Critical

Events & News

Agent Outcomes:

Enables more trading activity

- Automatically monitors for external news

- Organizes and summarizes per deal

- Audit trail to justify investment decisions

Community Banks

Community Banks

Check Processing

Agent Role:

Extract and validate

incoming checks

Agent Outcomes:

Enables more trading activity

- Ingests images in any format and quality

- Automatically applies validation logic

- Detects anomalies and potential fraud

Check Scanning for Marketing

Agent Role:

Scan and record info

on inbound checks

Agent Outcomes:

Target marketing campaigns

- Use during key acquisitions

- Enhanced prospecting data

- Create easy mailer list for potential new members

Commercial Loan Funding

Agent Role:

Automate reading, extraction and data entry of legal documents

Agent Outcomes:

Faster loan throughput & accuracy

- Capture accurate floating/variable rates

- Eliminate complexity of legalese

- Zero risk of manual entry error

Core Reconciliation

Agent Role:

Extract, label, and reconcile processes from disparate systems of records

Agent Outcomes:

Streamline data silos / systems

- Eliminate manual data entry/checks

- Advanced integration to core systems

- Provide intelligence and HITL feedback

DeepGPT

Agent Role:

AI content and context mining of proprietary data with financial services context

Agent Outcomes:

Chat with your data

- Knowledge base for team to use

- Easily updates and refines data

- Capture domain knowledge

Email Automation

Agent Role:

Email analytics and automation

Agent Outcomes:

Optimize your email flow

- Generated responses rooted in your data

- Data to drive immediate automation

- Streamlined workflow

Indirect Lending

Agent Role:

Automate manual & error prone work for loan applications

Agent Outcomes:

Faster loan throughput and funding

- Eliminate manual data entry

- Provide inline data quality

- Focus FTEs on Member/Customer Service

KYC Case File Analysis

Agent Role:

Resolve trade and documentation risk

Agent Outcomes:

Augment client due diligence

- Extract critical data from client documents

- Suggests reasoning narratives & actions

- Coordinates across teams

Loan Operations

Agent Role:

Automate manual & error prone

work for loan applications

Agent Outcomes:

Originate more loans faster

- Eliminates manual data entry

- Provide inline data quality

- Focus FTEs on higher value work

Loan Portfolio Audit/Data Quality

Agent Role:

Scrub loan portfolio to confirm accuracy of rates in core system

Agent Outcomes:

Accurate floating interest rates

- Change from spot check to full audit

- Improve reporting and insights

- Eliminate discrepancies across LOS & Core

Financial Market Infrastructure

Financial Market Infrastructure

Core Reconciliation

Agent Role:

Extract, label, and reconcile processes from disparate systems of records

Agent Outcomes:

Streamline data silos / systems

- Eliminate manual data entry/checks

- Advanced integration to core systems

- Provide intelligence and HITL feedback

DeepGPT

Agent Role:

AI content and context mining of proprietary data with financial services context

Agent Outcomes:

Chat with your data

- Knowledge base for team to use

- Easily updates and refines data

- Capture domain knowledge

Email Automation

Agent Role:

Email analytics and automation

Agent Outcomes:

Optimize your email flow

- Generated responses rooted in your data

- Data to drive immediate automation

- Streamlined workflow

Matching Engine

Agent Role:

Content matching from

multiple Systems of Record

Agent Outcomes:

ID and manage external breaks

- Daily highlights of trading breaks

- Escalate risks on daily close-outs

- Focus team on resolution instead of review

One View

Agent Role:

Connects content from

disconnected data sets

Agent Outcomes:

Unlocks optimization insights

- Single pane of glass to track system flows

- Simulate enhanced flows in client pitches

- Supports more volume

Security Settlements

Agent Role:

Resolve Settlement

Breaks

Agent Outcomes:

Enables more trading activity

- Generates responses based on your data

- Eliminates duplication and repeat tasks

- Generates cost-per-trade data

Standing Settlement Instructions

Agent Role:

Maintains SSI data

in any format

Agent Outcomes:

Accurate SSI data

- Zero delay in updating SSI data from clients

- Elimination of fails due to bad SSI data

- Identification of missing data

Trade Reconciliation

Agent Role:

Resolve Trade and

Documentation Risk

Agent Outcomes:

Enables more trading activity

- Resolve trade breaks with 100% accuracy

- Focus team on faster resolutions

- Auditability and transparency

Watch Tower

Agent Role:

Monitor Critical

Events & News

Agent Outcomes:

Enables more trading activity

- Automatically monitors for external news

- Organizes and summarizes per deal

- Audit trail to justify investment decisions

Capital Markets

Capital Markets

Check Processing

Agent Role:

Extract and validate

incoming checks

Agent Outcomes:

Enables more trading activity

- Ingests images in any format and quality

- Automatically applies validation logic

- Detects anomalies and potential fraud

Client/Advisor Retention

Agent Role:

AUM retention prediction

Agent Outcomes:

Retain your advisors and clients

- Analyze historical trade and balance activity

- Predict clients and advisor departure

- Alerts 3-6 mos. in advance

Core Reconciliation

Agent Role:

Extract, label, and reconcile processes from disparate systems of records

Agent Outcomes:

Streamline data silos / systems

- Eliminate manual data entry/checks

- Advanced integration to core systems

- Provide intelligence and HITL feedback

DeepGPT

Agent Role:

AI content and context mining of proprietary data with financial services context

Agent Outcomes:

Chat with your data

- Knowledge base for team to use

- Easily updates and refines data

- Capture domain knowledge

Email Automation

Agent Role:

Email analytics and automation

Agent Outcomes:

Optimize your email flow

- Generated responses rooted in your data

- Data to drive immediate automation

- Streamlined workflow

KYC Case File Analysis

Agent Role:

Resolve trade and documentation risk

Agent Outcomes:

Augment client due diligence

- Extract critical data from client documents

- Suggests reasoning narratives & actions

- Coordinates across teams

Matching Engine

Agent Role:

Content matching from

multiple Systems of Record

Agent Outcomes:

ID and manage external breaks

- Daily highlights of trading breaks

- Escalate risks on daily close-outs

- Focus team on resolution instead of review

Security Settlements

Agent Role:

Resolve Settlement

Breaks

Agent Outcomes:

Enables more trading activity

- Generates responses based on your data

- Eliminates duplication and repeat tasks

- Generates cost-per-trade data

Standing Settlement Instructions

Agent Role:

Maintains SSI data

in any format

Agent Outcomes:

Accurate SSI data

- Zero delay in updating SSI data from clients

- Elimination of fails due to bad SSI data

- Identification of missing data

Trade Reconciliation

Agent Role:

Resolve Trade and

Documentation Risk

Agent Outcomes:

Enables more trading activity

- Resolve trade breaks with 100% accuracy

- Focus team on faster resolutions

- Auditability and transparency

Check

Processing

Agent Role:

Extract and validate

incoming checks

Agent Outcomes:

Enables more trading activity

- Ingests images in any format and quality

- Automatically applies validation logic

- Detects anomalies and potential fraud

Check

Scanning

for

Marketing

Agent Role:

Scan and record info

on inbound checks

Agent Outcomes:

Target marketing campaigns

- Use during key acquisitions

- Enhanced prospecting data

- Create easy mailer list for potential new members

Client/Advisor

Retention

Agent Role:

AUM retention prediction

Agent Outcomes:

Retain your advisors and clients

- Analyze historical trade and balance activity

- Predict clients and advisor departure

- Alerts 3-6 mos. in advance

Commercial

Loan

Funding

Agent Role:

Automate reading, extraction and data entry of legal documents

Agent Outcomes:

Faster loan throughput & accuracy

- Capture accurate floating/variable rates

- Eliminate complexity of legalese

- Zero risk of manual entry error

Core

Reconciliation

Agent Role:

Extract, label, and reconcile processes from disparate systems of records

Agent Outcomes:

Streamline data silos / systems

- Eliminate manual data entry/checks

- Advanced integration to core systems

- Provide intelligence and HITL feedback

DeepGPT

Agent Role:

AI content and context mining of proprietary data with financial services context

Agent Outcomes:

Chat with your data

- Knowledge base for team to use

- Easily updates and refines data

- Capture domain knowledge

Email

Automation

Agent Role:

Email analytics and automation

Agent Outcomes:

Optimize your email flow

- Generated responses rooted in your data

- Data to drive immediate automation

- Streamlined workflow

Indirect

Lending

Agent Role:

Automate manual & error prone work for loan applications

Agent Outcomes:

Faster loan throughput and funding

- Eliminate manual data entry

- Provide inline data quality

- Focus FTEs on Member/Customer Service

KYC

Case

File

Analysis

Agent Role:

Resolve trade and documentation risk

Agent Outcomes:

Augment client due diligence

- Extract critical data from client documents

- Suggests reasoning narratives & actions

- Coordinates across teams

Loan

Operations

Agent Role:

Automate manual & error prone

work for loan applications

Agent Outcomes:

Originate more loans faster

- Eliminates manual data entry

- Provide inline data quality

- Focus FTEs on higher value work

Loan

Portfolio

Audit/Data

Quality

Agent Role:

Scrub loan portfolio to confirm accuracy of rates in core system

Agent Outcomes:

Accurate floating interest rates

- Change from spot check to full audit

- Improve reporting and insights

- Eliminate discrepancies across LOS & Core

Matching

Engine

Agent Role:

Content matching from

multiple Systems of Record

Agent Outcomes:

ID and manage external breaks

- Daily highlights of trading breaks

- Escalate risks on daily close-outs

- Focus team on resolution instead of review

One

View

Agent Role:

Connects content from

disconnected data sets

Agent Outcomes:

Unlocks optimization insights

- Single pane of glass to track system flows

- Simulate enhanced flows in client pitches

- Supports more volume

Security

Settlements

Agent Role:

Resolve Settlement

Breaks

Agent Outcomes:

Enables more trading activity

- Generates responses based on your data

- Eliminates duplication and repeat tasks

- Generates cost-per-trade data

Standing

Settlement

Instructions

Agent Role:

Maintains SSI data

in any format

Agent Outcomes:

Accurate SSI data

- Zero delay in updating SSI data from clients

- Elimination of fails due to bad SSI data

- Identification of missing data

Trade

Reconciliation

Agent Role:

Resolve Trade and

Documentation Risk

Agent Outcomes:

Enables more trading activity

- Resolve trade breaks with 100% accuracy

- Focus team on faster resolutions

- Auditability and transparency

Watch

Tower

Agent Role:

Monitor Critical

Events & News

Agent Outcomes:

Enables more trading activity

- Automatically monitors for external news

- Organizes and summarizes per deal

- Audit trail to justify investment decisions

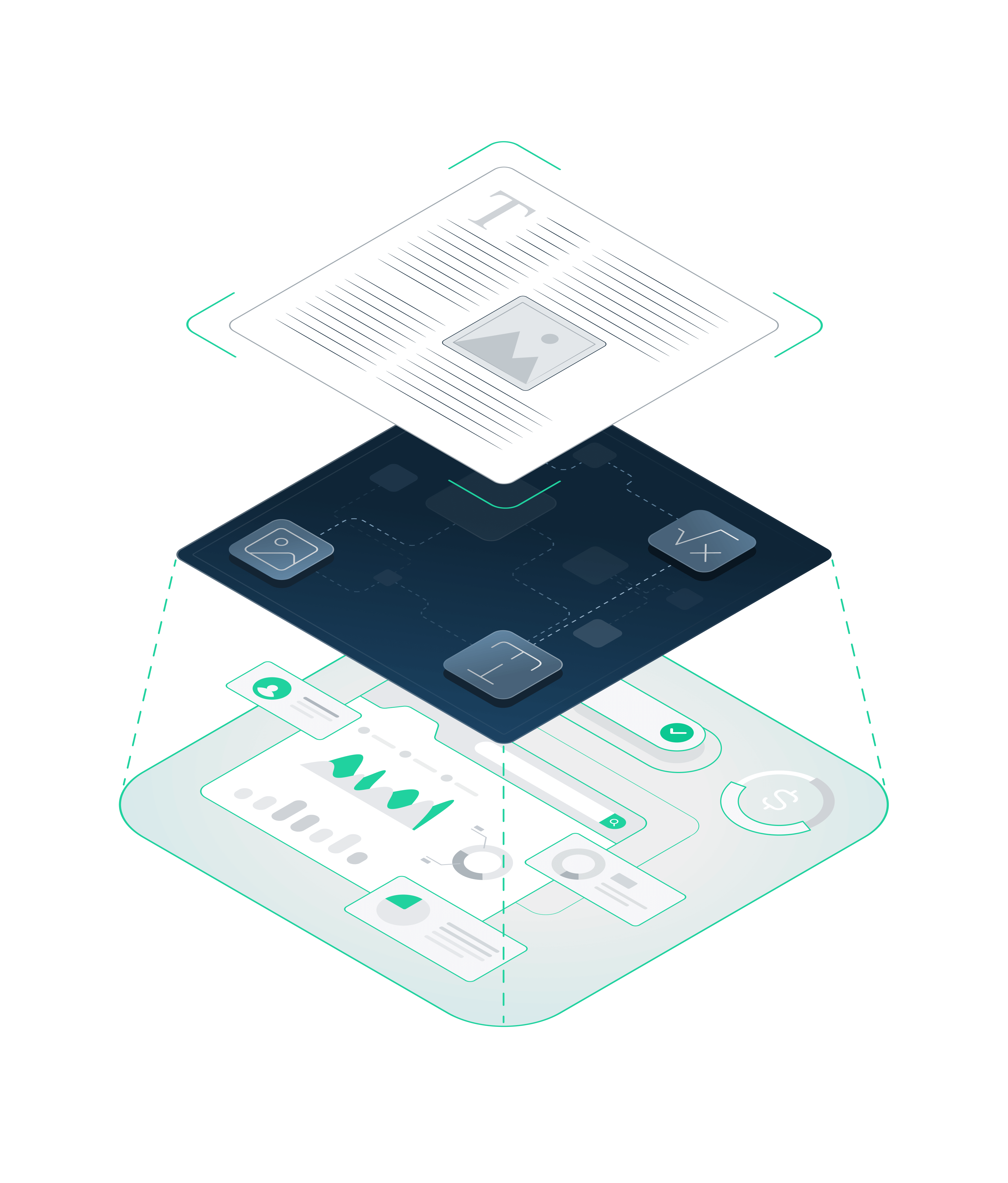

What are DeepSee AI Agents?

DeepSee AI agents are specialized digital assistants purpose-built for banking operations. They combine deep financial expertise with advanced technology to automate complex processes.

Vertically Focused Agents That Work for You

Mine any content to identify banking requirements, assign tasks to the right agent, and reduce manual work—so teams focus on exceptions, scaling expertise and reducing risk.

AI Platform Training and Tuned for Banking Use Cases

Agents use AI to extract and categorize content by context, not layout, enabling automation, compliance, and real-time data reconciliation across any format.

Next-Gen Content Understanding and Knowledge Retention

Agents label, fact-check, and extract key information, storing insights in a knowledge graph for advanced AI and continuous learning with human feedback.

Who We Serve

DeepSee’s intelligent platform is designed to address the unique needs of key stakeholders across the financial organization.

Analyst

Hands-on keyboard end users

who implement and interact with

AI agents daily.

- Reducing tedious manual processes

- Increasing daily productivity

- Eliminating errors in routine tasks

- Gaining time for higher-value work

Team Manager

Focused on team performance and operational visibility, seeking insights to drive efficiency gains.

- Reducing tedious manual processes

- Increasing daily productivity

- Eliminating errors in routine tasks

- Gaining time for higher-value work

Executive

Concerned with overall business outcomes, seeking ways to reduce risk and drive revenue growth.

- Reducing tedious manual processes

- Increasing daily productivity

- Eliminating errors in routine tasks

- Gaining time for higher-value work

Core Capabilities

Intelligence Engine

- Sector-specific models and ontologies

- Grounded, advanced reasoning framework

- Continuous-learning architecture

- API integration to external knowledge/data sources

Enterprise Architecture

- Zero-trust architecture

- Data lifecycle encryption (CMK, BYOK)

- Discrete, per-customer enclaves

- Kubernetes, cloud-scale security & resilience

Integration & Scale

- Infrastructure as Code (IaC)

- Policy as Code (PAC)

- Global availability, regional confinement

- Cloud-native, secure APIs

Operational Excellence

- Process transparency/observability

- Near-real-time monitoring

- Mature risk management practice

- Security, confidentiality and availability first

Evident AI

Outcomes Report

Is there a formal process at the bank to capture ideas for AI use cases?

Which AI use cases should banks be prioritizing?

How is AI unlocking value for banks?

How do banks’ AI outcomes compare to their peers?

Does the bank have a central repository of the organization’s AI/ML use case portfolio?

Platform Benefits

DeepSee empowers your entire organization: developers benefit from modern, documented architecture for quick deployment, operations teams leverage no-code controls, and executives see immediate ROI through reduced risk and enhanced banking efficiency.