Financial Services DNA:

DeepSee is Purpose-Built for Banking

Front to back office coverage

Pre-built banking workflows

Knowledge mining that scales

The Old Way Isn’t Working. Financial institutions

are struggling with:

Growing transaction volumes that strain resources

Legacy systems that can’t scale with your business

Manual processes that slow operations and increase risk

Complex regulations that demand perfect accuracy

Multiple vendors doing similar work

Growing transaction volumes that strain resources

Legacy systems that can’t scale with your business

Manual processes that slow operations and increase risk

Complex regulations that demand perfect accuracy

Multiple vendors doing similar work

How We Help

DeepSee Agents analyze disparate data sets and automate banking-specific tasks, while also providing the transparency compliance teams require.

Banks

Supercharge your teams to focus on what matters most. Whether you’re just beginning your automation journey or enhancing existing processes, our AI Agents are designed to streamline labor-intensive tasks, improve operational efficiency, and unlock

new revenue opportunities. Let us help you transform productivity while enabling your team to prioritize strategic growth initiatives.

Financial Market Infrastructures

Enhance your offerings with domain-specific expertise. While large system integrators and horizontal AI platforms provide scale, we bring deep financial services knowledge to the table. Our AI Agents integrate with existing systems, enriching them with contextual intelligence to tackle the complexities of financial markets. Together, we’re elevating the standard for innovation in financial infrastructure.

See Agents See Agents

Capital

Markets

Built for the most sophisticated firms on Wall Street. Our AI Agents deliver proven results across front, middle, and back-office operations at leading financial institutions. From streamlining workflows to scaling complex processes, we help capital markets firms achieve operational excellence and drive measurable outcomes in the most demanding and heavily regulated environments.

See Agents See AgentsIntelligent Automation for Financial Services

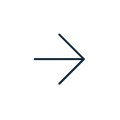

Financial Automation

Automate simple or complex financial services processes end-to-end.

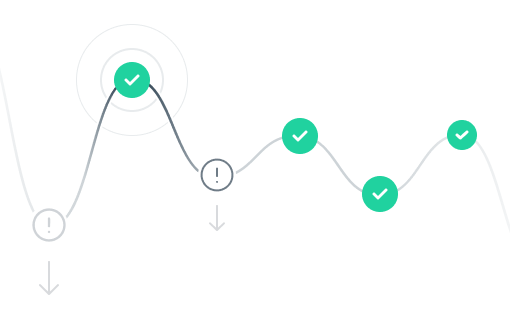

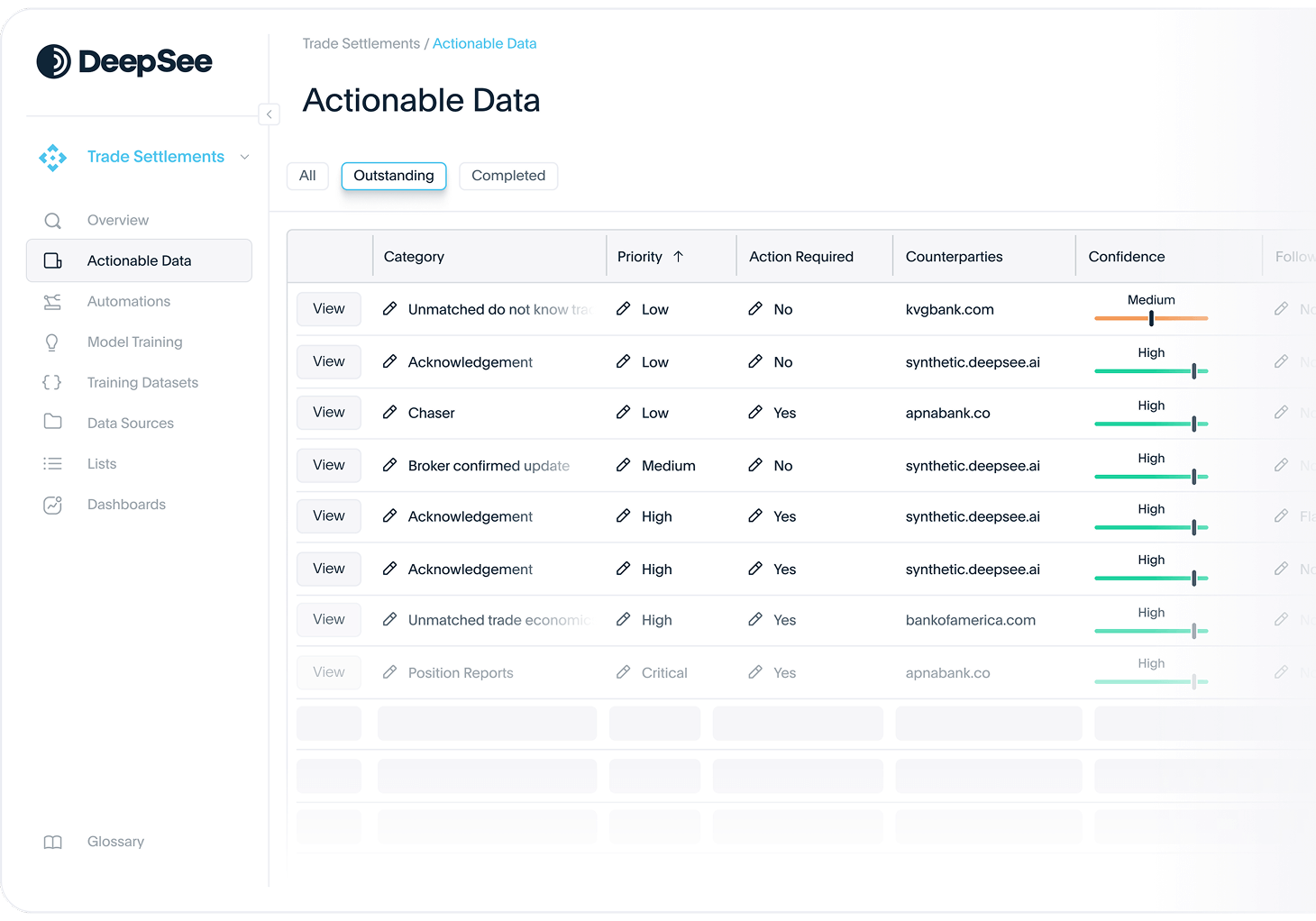

Actionable Knowledge

Chat directly with your proprietary data and receive instant, precise answers to complex questions.

Gain Visibility

Mines emails, pinpoints process inefficiencies, and identifies automation opportunities.

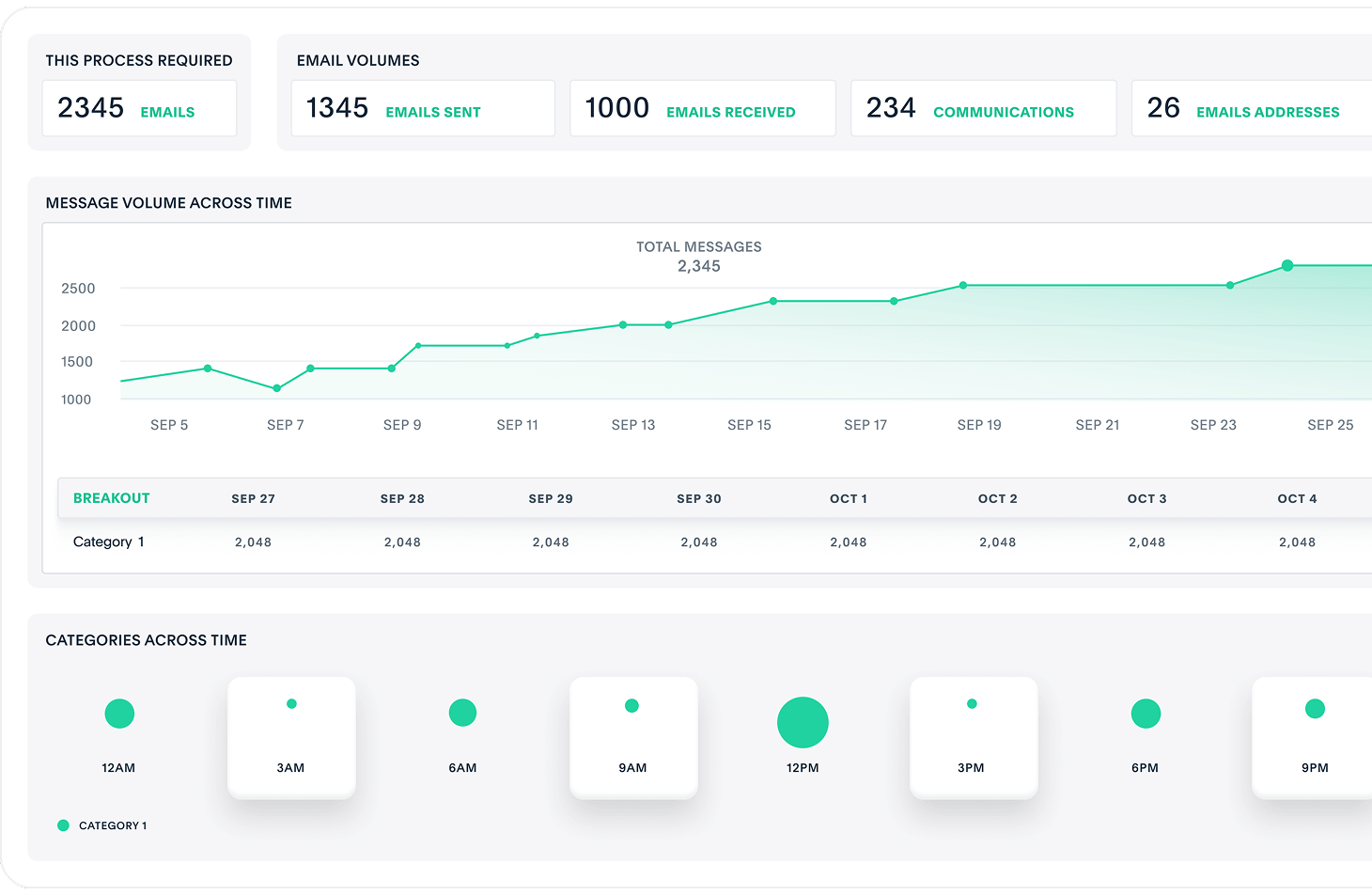

Transform Data into Opportunity

Access powerful insights that reveal key business drivers, helping you optimize performance.

Unified workspace view

Error reduction at scale

No-code UI

Tailored for financial workflows

Powered by your data

Accelerated, smarter decisions

Email-first operations

Process breakdowns

Visibility into team performance

Simplified, consolidated data

Gaining a competitive edge

Reporting and setting KPIs

Return on Investment

Transformative Results for Banking Operations

$45MM

Risk eliminated – Tier 1 Global Securities

3K+

Breaks identified – Tier 1 Post Trade

4.8K

FTE hours saved – Tier 1 Operations

30x

Efficiency gain with volume increase

50%

Inbox reduction via automation

37%

FTE reduction despite higher volumes

100%

Post-trade visibility achieved

Competitive Advantage

Competitors

The DeepSee Difference

| DeepSee AI | Traditional Tools | |

|---|---|---|

| AI-Powered Financial Workflows |

|

|

| Domain-Specific Knowledge Automation |

|

|

| LLM Fine-tuning for Regulated Industries |

|

|

| Integration with Existing Platforms |

|

|

| Real-Time Data Extraction from Unstructured Documents |

|

|

| Automated Compliance & Audit Trails |

|

|

| Customizable Templates for Industry-Specific Use Cases |

|

|

| High-Touch Support & Fast Deployment |

|

|

| Cloud and On-Premise Flexibility |

|

|

| Intelligent Error Detection and Correction |

|

|

AI-Powered Financial Workflows

DeepSee AI

Traditional Tools

Domain-Specific Knowledge Automation

DeepSee AI

Traditional Tools

LLM Fine-tuning for Regulated Industries

DeepSee AI

Traditional Tools

Integration with Existing Platforms

DeepSee AI

Traditional Tools

Real-Time Data Extraction from Unstructured Documents

DeepSee AI

Traditional Tools

Automated Compliance & Audit Trails

DeepSee AI

Traditional Tools

Customizable Templates for Industry-Specific Use Cases

DeepSee AI

Traditional Tools

High-Touch Support & Fast Deployment

DeepSee AI

Traditional Tools

Cloud and On-Premise Flexibility

DeepSee AI

Traditional Tools

Intelligent Error Detection and Correction

DeepSee AI

Traditional Tools

Case Studies

Wondering what it’s like to work with DeepSee? See what our customers are saying.

SOC 2 Type II Certified

DeepSee is committed to security and compliance. We regularly audit business-critical data and processes to ensure the highest standards.

News & Insights

Stay informed on company announcements, product launches, and media coverage—right here in our newsroom.

07_29_2025

DeepSee Awarded ICBA ThinkTECH Accelerator Most Valuable Participant

link06_20_2025

Altaira joins forces with DeepSee.ai to Build Next-Gen Operating Model for Private Funds

link04_08_2025

DeepSee.ai Joins Microsoft for Startups Pegasus Program to Deliver Production AI in Financial Services

linkPut knowledge to work.

Accelerate AI adoption for financial services in front, middle, and back-office operations.